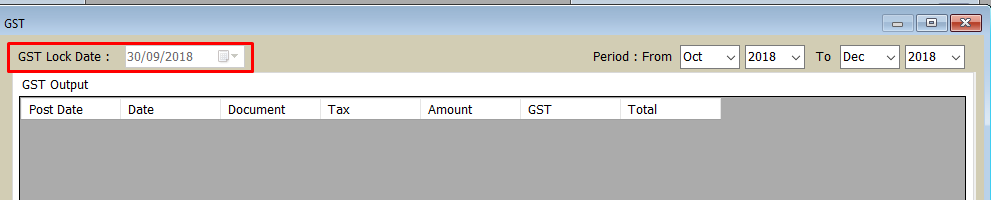

GST available dates.

For SAM system,

We have improved on the GST portion of the system.

The date range available for report generation depends on the last lock period.

base on the last lock period you can generate reports 5 years into the past and 1 year into the future.

eg if the last lock period is 2020, you will have the option generate reports up to 2021.

and as far back as 2015

If your last lock period a few years from the present you will need to do the following.

- ensure that there are no outstanding changes for the previous periods.

- lock the period to the last day before the next submission.

eg.If you are doing Jan 2020 GST, you will lock till 31 dec 2019.

you can lock across multiple years.

eg. If your last lock date is 2018, and you are doing Jan 2020 GST, you can lock the period from 2018 till 31 dec 2019.

To lock the period set the date range.

then click on 'post' button. if 'post' button not visible you will need the GSTADMIN role.

After Clicking 'Post' button, you will need to close and open the GST module for the changes to affect the date ranges.

Note. As your lock period is not current, this means that the records on the system may not match what you have submitted to IRAS.

you will need to use your external records should you need to generate reports for those periods.

the system will put '01/01/1900' as your last lock date when there was no lock period.

Related Articles

2.0. Accounting Lock Type Control Setup

Accounting Lock Type Control STEPS: Click SETUP activity Click ACCOUNTS Click A/C SETTING module Click EDIT To understand, first you have to understand that every accounting document (e.g. sales invoices) has two dates. Transaction Date – date of the ...GST Optimizations

In order to improve GST performance we have made changes to the GST workflow. Key Changes Once locked, the GST period cannot be unlocked.There are no more commit/uncommit buttons. Transactions that are created with a post date in a GST locked period, ...Changes to GST Post

To make changes inside a GST Locked period, you will have to enable the following setting: Once enabled, anyone may add/edit transactions within GST Locked period. You may consider setting Authorisation Password. Users will be prompted to enter a ...Date range in Trial Balance, Balance Sheet and P&L

When generating reports in the system the date range filters affect the values you generate. Our system has the following range filters. Balance: Include all entries till today's date. If today's date is in 2019. when i select balance filter it will ...GST API Frequently Asked Questions.

GST Seamless Filing User Guide Link https://support.ocisystem.com/portal/en/kb/articles/gst-api-training-30-4-2024-1#GST_API_Training_Slides How can I ensure the system submission was sent successfully? You can log into the https://mytax.iras.gov.sg ...