Troubleshooting improper Trade Debtor/Creditor entries (Aging).

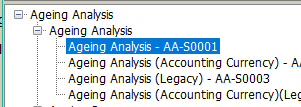

- Understanding the different Aging reports.

- Standard Aging Reports

- the standard aging reports only includes properly created entries.

- a proper entry is a entry a entry that affected a trade debtor/creditor account that has a BP code and document number

- Legacy Aging Reports

- the legacy report include all entries that affect the trade debtor/creditor accounts.

- these report gave users the false impression that their entries properly done.

- since the legacy reports show all, we can use the reports to help identify entries that have issues.

- Using the Legacy report to find entries with missing BP

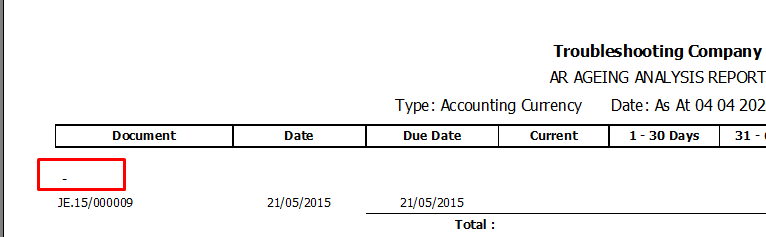

- use either of the legacy report to generate the aging. search for entries similar to the screenshot below.

- in the report entries with no BP will appear with just a dash.

- since these entries have no BP and document, you'll need to specify both or change the account to a non trade debtor/creditor type account (You should consult your accountant /auditor on which account to use.)

- Using Legacy report to fine entries with missing document

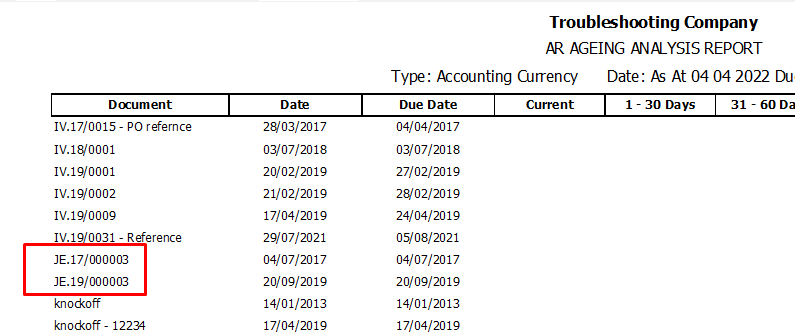

- use either of the legacy report to generate the aging. seach for entries similar to the screenshot below.

- entries with missing document will show up as the Journal Entries.

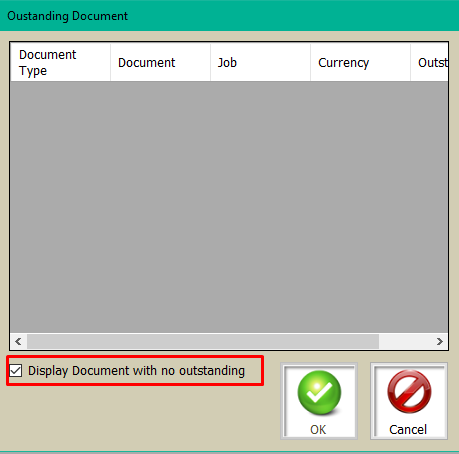

- you'll need to specify the document in the JE. note if the document does not show up when clicking on document column. tick the display document with no outstanding.

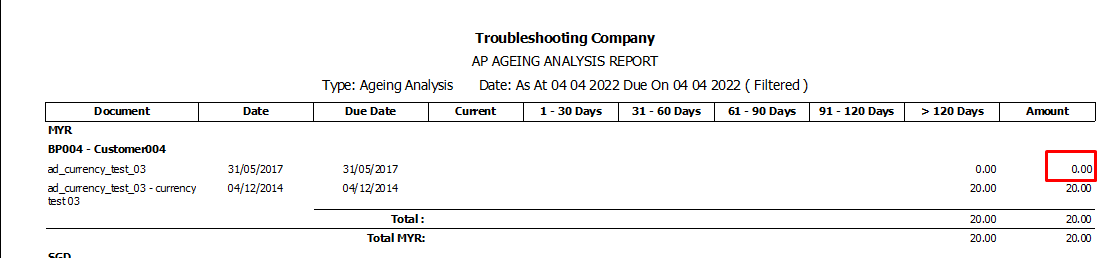

- Using Standard report to find entries with outstanding accounting currency.

- use the aging report with transaction currency.

- entries that appear with zero value are entries that have zero transaction currency value but have left over accounting currency value.

- common causes are users editing the invoice after importing to the voucher or users editing the accounting currency on the voucher. these actions override the system's built in action to ensure that when the transaction currency is zero the account currency is zero.

- to fix you'll can manually create a JE to move the accounting currency to the exchange gain/loss account or reimport the invoice into the voucher.

- if you are choosing to reimport the voucher, you will need to do the action on the existing voucher.

- copy any description you have type.

- remove the invoice from the voucher.

- import the invoice back in. paste back the description( if any)

Related Articles

Improper knock off

Improper knock off occurs when using the Journal Entry module and the entries are improperly created. Sample of incorrect entry. the Trade Debtor row has a Business Partner selected but no document is selected. With no document specified, this ...

1.0. Opening Entry Overview

Opening Entry Opening entries are essential for transitioning financial data into the new system accurately. They align general ledger balances, outstanding AR/AP documents, and inventory as of a chosen, audited date. This process ensures the ...

7.0. Opening Adjustment Check

Opening Adjustment Check The Opening Adj. Check module is for checking that the Opening Entry has been completed correctly. Ensure that the following amounts match up: Opening Invoice total with Trade Debtors account(s) Opening Supplier Invoice total ...

Trial Balance/General Ledger values not matching with Ageing values.

When comparing the Trial Balance values against Ageing, we are looking at the Trade Debtor/Creditor accounts. Ageing Report In order for the report to generate values, the Trade Debtor/Creditor accounts needs to have the following information. 'Who' ...

9.0. Accounts Payable in Foreign Multi Currency

Making a USD deposit to Supplier STEPS: AMOUNT enter 1,000 USD BANK RATE check if it’s 1 PAYMENT AMOUNT check for 1,000 Click ADD Close module STEPS: Click REPORT activity Click AR/AP Click STATEMENT OF ACCOUNT module BUSINESS PARTNER select ...