3.0. YEC Verify

Select the year end closing period

STEPS:

- Go to ADJUSTMENT Activity

- Click on CLOSINGS Module

- Select YEAR END CLOSING

- Select the Financial Period for closing, display on the top left module

Note that the period for the closing available because we have set the status as Finalising.

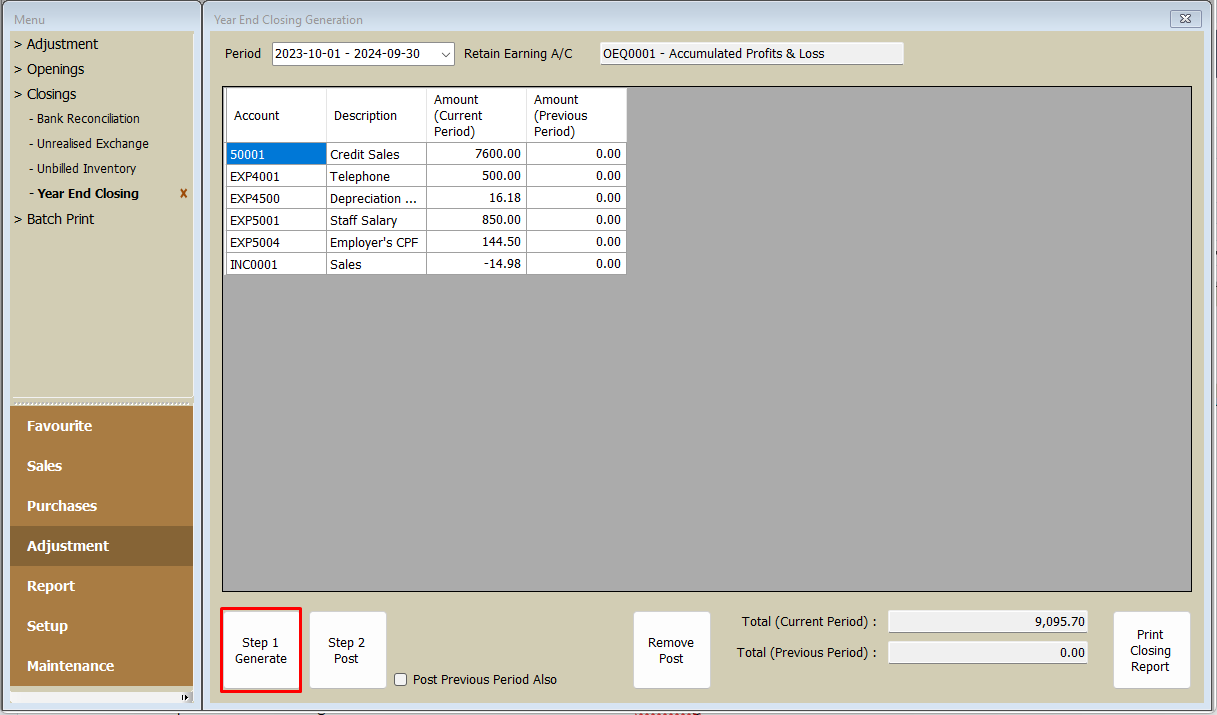

Generate the year end closing

STEPS:

- Click STEP 1 GENERATE, display on the left bottom module

To list out all the Profit and Loss items. - Profit & Loss item will show, display on the left middle module

Related Articles

8.1. Why is Current Profit/Loss at Balance Sheet different from Profit/Loss report

Commonly when there is a difference in the P&L and BS this usually indicates that Year end closing was not done for a period. (note this may apply to multiple periods) Adjustments were made after year end closing was done. ( note this also can apply ...5.0. YEC Check

Check after Post - Print the Profit & Loss Report STEPS: Click on REPORT Activity Click on FINANCIAL Module Select PROFIT/LOSS The profit and loss statement is a summary of the income for a period and subtracts the expenses incurred for the same ...8.3. Do you have Adjustments after Year End Closing?

After Year End Closing (YEC) has been done, then you generate the P&L and tick 'include Current Year End closing' the value should be zero. If you made audit adjustments, then you may have values that were not included in the YEC. For example, FY ...1.0. YEC Quick Overview

YEC Preparation The main purpose of Year End Closing process is to move the Profit/Loss amount incurred over the Financial Year (stored in Expense, Cost & Income accounts) to the Retained Earnings account. Ensure that all previous Financial Periods ...4.0. YEC Post

Post the year end closing Note that the system has calculated the amount to b/f to Balance Sheet at “Total (Current Period)” and the “Total (Previous Period)” should be zero if have closed the previous year properly. Otherwise you can post together ...